Managing Healthcare Costs in Retirement with UnitedHealthcare’s Elena McFann

In a recent survey, 43 percent of newly retired people said they were spending more on health care than they had planned. One of the primary reasons? Many people mistakenly buy into several common myths about health care costs in retirement, leading to unpleasant surprises that strain people’s wallets and create unnecessary stress.

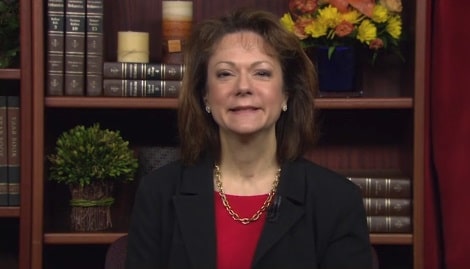

Elena McFann, Central region CEO of UnitedHealthcare Medicare & Retirement, is here to debunk many of these common myths.

Elena will share important information that can help your viewers separate fact from fiction when it comes to managing their health care costs. Her tips will leave your viewers better prepared to make smart, confident health care decisions, helping them save money in the process.

Some of the myths that Elena will debunk for your viewers:

· Once you turn 65, Medicare covers all of your health care costs.

· If you’re looking to save money, it’s best to choose the lowest-premium plan.

· Medicare covers vision, dental and hearing care, just like with your employer-sponsored plan through work.

· There’s no need to sign up for Part D prescription drug coverage if you’re not currently taking any drugs. After all, why buy something you’re not going to use?

· If you’re a snowbird or a frequent traveler, it’s important to get all the health care services you might need before setting off on your travels as they won’t be covered when you’re away from home.

TALENT: Elena McFann is the Central region CEO of UnitedHealthcare Medicare & Retirement, the largest business dedicated to serving the health and well-being needs of seniors and other Medicare beneficiaries. One in five Medicare enrollees has chosen UnitedHealthcare for their coverage.

More information is available in the newsroom on UHC.com.

Interview courtesy of UnitedHealthcare

Related links: Medicare Made Clear